The business world is constantly changing, and the ability to adapt is essential. Innovative thinking allows you to stay ahead of the competition, meet evolving customer needs, and capitalize on new opportunities. Your sales strategy should include clear goals, target demographics, and effective sales techniques tailored to your market. Train your team regularly to ensure they are equipped with the latest and most effective sales methods. By providing your information, you agree to our Terms of Use and our Privacy Policy.

Measuring Financial Performance: Metrics for Success

Tracking key performance indicators (KPIs) allows you to gauge your business’s financial health. Learn about important metrics and how they reflect your overall performance. Learn how to adapt your financial strategies to navigate through challenging times and seize opportunities for growth. For example, let’s say you’re deciding whether to add outdoor seating for your sausage themed restaurant, Haute Dog.

Navigating the Landscape of Business Finance Management

Knowing the state of your financial affairs back to front is one of the best ways to make sure the cash keeps flowing. Staying on top of your finances means avoiding unforeseen business debt and having enough money to invest in and grow your business. Friends, managing your finances effectively is a key to success in the small-business world. By following these simple tips, you can navigate the financial challenges and opportunities that come your way with confidence.

- Borrowing money can provide the necessary capital, but it’s essential to manage debt responsibly.

- It’s your road map to setting realistic revenue and expense expectations.

- Online invoicing systems streamline the billing process, ensuring that invoices are sent out promptly and accurately.

Start with a balance sheet

Compliance with financial regulations is essential to avoid fines and legal issues. Stay informed about relevant tax laws, labour laws, and industry-specific regulations that affect your business finances. Consider consulting with a financial advisor or accountant to ensure you’re meeting all your legal obligations and taking advantage of any tax incentives or benefits available to your business. Plan how you would like your business’s trajectory to look, plan the goals you want to achieve along the way, and plan how you plan to achieve those goals. You may think budgeting restricts the goals you want to achieve with your business, but really it’s a way of ensuring you’re more likely to achieve them.

There are endless options out there for small business financial tools. Some, like loans, can help you get the capital you need to grow your business. Others, like small business credit cards, can be useful for making regular, periodic business purchases and earning rewards. If you need to keep costs low, consider outsourcing to someone https://www.simple-accounting.org/ who can spend a couple of hours a month reviewing your DIY bookkeeping and providing strategic advice. As your business grows, you can always scale up their services to get help with payroll, inventory, cash flow management and more. Every business owner has a client that is consistently late on their invoices and payments.

Financial Forecasting: Charting a Path to Success

For funding larger projects or business needs — like a renovation, equipment, or new marketing campaign — a business loan might be the way to go. Take a close look at all of your business expenses (direct and indirect) and overhead costs (fixed, variable, and semi-variable) to calculate your overhead rate, and monitor it on a regular basis. Review your business reports, and assess your core business and financial operations in relation to your sales and operating margins. If you have trouble saving for your quarterly estimated tax payments, make it a monthly payment instead, said Michele Etzel, owner of Bayside Accounting Services. That way, you can treat tax payments like any other monthly operating expense.

You use the numbers on your balance sheet to determine whether your business can pay its bills and understand whether you can purchase additional assets or take out loans. For example, the IRS allows business owners to deduct business-related expenses, such as business travel and supplies. However, you have to keep proper documentation to support those deductions. If the IRS audits your return and you don’t have a clear record showing which transactions were business related and which were personal, you could lose out on those deductions. Effective time management allows you to prioritize tasks, meet deadlines, and maintain a healthy work-life balance.

Budgeting and forecasting are the cornerstones of effective financial management. A well-planned budget helps you to control spending, allocate resources efficiently, and prepare for future financial needs. Meanwhile, forecasting allows you to predict future income and expenses, helping you make informed decisions about growth opportunities and potential investments. Regularly reviewing and adjusting your budget and forecasts ensures that your business remains on solid financial footing. In many organizations, the Chief Financial Officer (CFO) plays a central role in https://www.business-accounting.net/how-do-you-find-net-income-with-total-assets-and/. They provide strategic financial leadership, oversee all financial operations, and make crucial financial decisions that shape the company’s financial trajectory.

Irrespective of your business profile, you can manage your company’s finances using some simple accounting strategies. One of the areas of work that you need to master from the very beginning of your business is finances and accounts. The right time to manage all your business finances is from the start of this journey. A crucial factor in the constant growth of small businesses around the globe is a well-planned and implemented accounting strategy. As a business owner, you must track your revenues, expenditures and profits systematically right from the start of your business. Financial management software can automate many of the tedious aspects of managing your business finances, from tracking expenses and revenues to generating detailed financial reports.

The accrual method puts transactions on the books immediately upon completing the sale. Education and organization are two keys to ensuring your business is financially healthy. The opinions expressed in this article are not intended to replace any professional or expert accounting and/or tax advice whatsoever.

The below tips are designed to help you keep on top of your finances when running a business. Both periods of growth and stagnation will occur when running a business, and each can be as much of a threat to your financial management as the other. The important thing is to plan ahead, keep a consistent eye on your books and manage your bills.Read on and take steps towards good financial management.

We may receive compensation from our partners for placement of their products or services. We may also receive compensation if you click on certain links posted on our site. While compensation arrangements may affect the order, position or placement of product information, it doesn’t influence our assessment of those products. Please don’t interpret the order in which products appear on our Site as any endorsement or recommendation from us. Finder.com compares a wide range of products, providers and services but we don’t provide information on all available products, providers or services. Please appreciate that there may be other options available to you than the products, providers or services covered by our service.

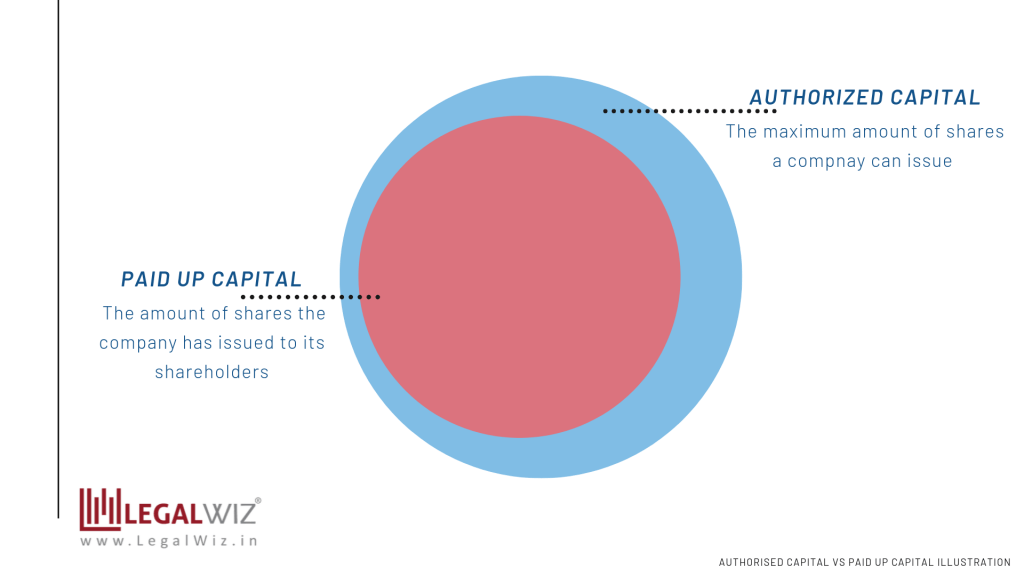

Small businesses tend not to have enough capital to get themselves through the startup phase. To prevent this, have three months’ living expenses saved plus the amount you are expecting to need for the first three months’ business expenses. An easy mistake to make is waiting until your business is in financial trouble before applying for loans or other credit. Consider applying for a business loan when your financials are still in a good state. This way the loan can be used for expansion or as an emergency line of credit instead of rescue.

After a week or month, it can be easy to forget about accounts receivable. But if you want to better manage money, you must remember the funds owed to your business and pursue payments. accelerating deductions with payroll tax accruals In the ever-evolving financial landscape, continually learning how to manage business finances and enhancing your financial knowledge and staying adaptable is essential.

For instance, budgeting for small businesses can help pinpoint potential cash flow crunches, giving you time to act before it’s too late. Borrowing money can provide the necessary capital, but it’s essential to manage debt responsibly. Learn how to evaluate borrowing options, negotiate terms, and create a plan for timely repayment. It’s the money moving in and out of your accounts that keeps your operations running.

Be the first to comment on "How To Manage Your Business Finances"