Our commitment to accuracy and completeness in managing outsourcing services has helped us grow our business by leaps and bounds. We follow the standard accounts payable process, such as maintaining the master vendor file, receiving and uploading invoices into a financial system, verifying, and approving and processing payments. As a specialized accounts payable outsourcing company, we guarantee you services that will ensure your financial statement and cash position is healthy and transparent. However, accounts payable automation may not be suitable for all businesses, as it may not offer the same level of human oversight and adaptability as outsourcing accounts payable processes. Additionally, implementing accounts payable automation software may require a significant initial investment (or recurring SaaS fees) in software and training of in-house employees. Also, some organizations may prefer to retain direct (manual) control over their accounts payable operations.

Tailored Outsourced AccountingServices For CPA Firms

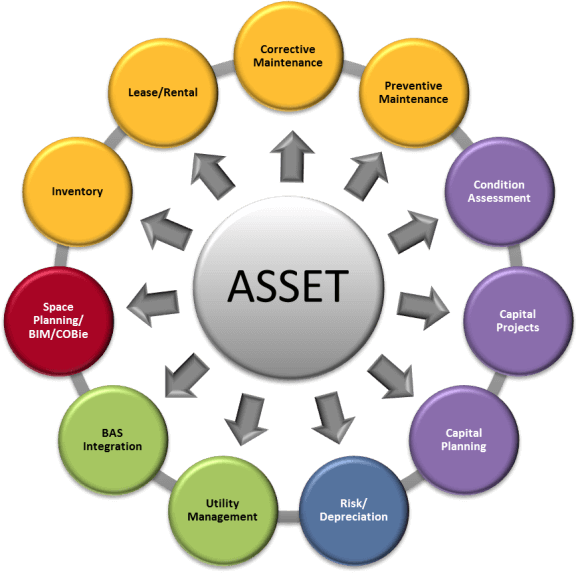

In the process, we have successfully kept all our clients’ stakeholders happy and assisted them to focus on all their mission-critical issues. In today’s digital age, the technology used by the AP service provider is crucial. They should offer advanced solutions like automation, electronic invoicing, and cloud-based systems. These technologies not only streamline the AP process but also provide greater visibility and control. Inquire about their data security measures and compliance with regulations like GDPR or HIPAA, if applicable. Vendor management services are essential for cultivating positive partnerships and optimizing supplier communication.

Effective Use of Time

Botkeeper stands is last but not least on our list, leveraging advanced artificial intelligence and machine learning technologies to offer automated bookkeeping services. Their innovative platform seamlessly integrates with a company’s existing systems, providing real-time financial insights and more accurate, up-to-date reporting. Botkeeper’s unique approach combines the precision of AI with human oversight, ensuring a high level of accuracy and customization. This blend of technology https://www.accountingcoaching.online/ and expertise makes Botkeeper an ideal solution for businesses looking to modernize their financial processes while maintaining reliability and efficiency in their accounting practices. Their service effectively reduces the workload on internal staff, allowing businesses to focus on growth and strategic decision-making. Paro has emerged as a dynamic force in the finance and accounting outsourcing sector, known for its highly personalized and flexible service offerings.

Best Finance and Accounting Outsourcing Companies

Additionally, upgrading those old accounting systems to modern solutions such as Quickbooks can be costly and time-consuming. An increasing number of businesses are outsourcing their accounts payable processes to a specialized third-party team. Selecting the right accounts payable service provider is critical to https://www.accountingcoaching.online/what-is-restricted-cash-on-financial-statements/ ensure a successful partnership. Below are our top tips for three areas to consider when choosing the best AP outsourcing provider. Furthermore, by working with an AP outsourcing provider, businesses can ensure that they maintain a high level of compliance with financial regulations and industry best practices.

- AP outsourcing companies don’t just follow best practices when doing their work.

- In an earlier blog post, we explained that manually processing a single invoice can cost as much as $30.

- You may have hesitations about working with a third-party, or it may not be a reasonable choice in your industry.

- Botkeeper’s unique approach combines the precision of AI with human oversight, ensuring a high level of accuracy and customization.

When a business decides to outsource its AP, a third party manages the AP department. Third-party accounts payable outsourcing services will typically use their own AP automation software to achieve efficiency. Vendor relations should be taken as a customer service approach, because vendors can (and will) pull contracts from your company if they find it difficult to work with your business. From missed due dates or non-payments, what is the difference between income and profit vendors will be in touch with the AP department to track down the status of their payment which again, takes away valuable time from accounts payable. No matter the circumstance, when a vendor is missing a payment, it’s always your fault. Vendors will sometimes resend the same invoice and through multiple mediums to ensure they are paid, which as mentioned in the previous listed issue, can result in double-paying an invoice.

Define and track SLAs based on what’s important for your business.

The strategic management of finance and accounting has transcended traditional in-house operations, propelling forward-thinking companies towards the efficient and innovative realm of outsourcing. The time has come to choose your knight in shining armor, your partner in crime, your accounts payable service provider. Get ready for a laugh-out-loud adventure through the murky waters of provider selection. Laugh all the way to the bank as you witness the incredible reduction in expenses and the hilarity of watching your budget stretch like a rubber band. Outsourcing this beast of a process will have you in stitches as your efficiency levels skyrocket. Watch in awe as AP tasks are completed with lightning speed, leaving you with more time to appreciate the hilarious beauty of life.

When choosing a provider, consider factors such as the size and nature of your business, industry-specific expertise, and the complexity of your financial requirements. Look for a provider that not only offers a range of services but also demonstrates a deep understanding of your industry’s unique financial challenges and regulatory environment. Assess their technology stack to ensure it integrates seamlessly with your existing systems and offers the scalability to accommodate future growth. Additionally, evaluate their track record in client satisfaction and their approach to client communication and support. A provider that combines technical expertise with a strong client relationship focus is likely to be a valuable partner in driving your business’s financial success.

It’s like having a comedy script that guarantees a happy ending for your business. Outsourcing your accounts payable tasks not only saves you money but also frees up valuable resources within your organization. Instead of hiring and training an in-house AP team, you can rely on the expertise of a dedicated service provider. It’s like having a never-ending comedy show where the punchline is a fatter bottom line. They understand that accuracy is paramount when it comes to managing accounts payable.

AP Automation, on the other hand, refers to the use of software to automate AP tasks within the organization. This technology streamlines processes like invoice capture, approval workflows, and payment processing. While it reduces manual work and improves efficiency, it requires investment in software and may still necessitate internal management and oversight. This can include invoice processing, payment execution, tax and regulatory compliance, and even strategic financial planning and analysis. Having a full suite of services ensures that all your AP needs are covered under one roof, simplifying management and communication.

One of the biggest benefits of outsourcing accounts payable processes is the potential for significant cost savings. The improved efficiency mentioned in the previous point will lead to savings in several areas, such as reduced invoice processing costs and increased vendor discounts. Outsourcing accounts payable processes can lead to significant improvements in efficiency for businesses. By leveraging the expertise and technology of a third-party provider, organizations can streamline their AP workflows and reduce the time spent on manual tasks such as data entry and invoice processing. Efficient invoice receipt and processing can lead to cost savings and improved accuracy, reducing the likelihood of manual data entry errors and facilitating better cash flow management. By partnering with an experienced outsourcing provider, your organization can benefit from their expertise and technology to streamline this function.

Additionally, missed or late payments cost your staff time when they have to right the wrong by recovering erroneous spend, which in turn, reduces time available for other AP functions. Sharing financial information with a third party involves inherent risks in data security and privacy, requiring trust and strong safeguards from the provider. However, those businesses which can incorporate automation, e-invoicing, and other efficiency tools will gain an edge over their competitors. They’ll even negate many of the problems that have plagued AP departments for decades.

Their accountant updates your business’ books, prepares financial statements and takes care of statutory compliance. They help your business grow by preparing the budget and forecasting its needs. Today, even small businesses in Singapore want to outsource their non-core tasks like bookkeeping & accounting. Appointing of experienced accounting services providers enables them to focus on their main business goals like customer satisfaction and business profit.

Be the first to comment on "A guide to outsourced accounting: All you need to know"